Handout: Global Imbalances and Risks

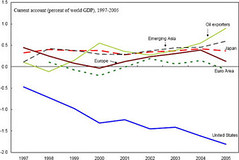

The regional course of trade deficits and surpluses: 1997-2005.

Source: IMF, via Global Economy Matters: Structural Drivers of Global Macroeconomic Imbalances.

The Situation:

Net capital inflow: $600B (from foreign central banks) + $200B (from foreign private wealthy) = $800B a year.

This must balance:

Trade deficit: $800B a year

What happens if the $600B of net capital flowing in from foreign central banks disappears?

- U.S. interest rates go up--supply and demand in the capital market for loanable funds.

- U.S. dollar's value goes down--supply and demand in the market for foreign exchange.

- A less-valuable dollar raises dollar-value exports and lowers dollar-value imports.

- Higher interest rates pull in more capital, which partially offsets the decline in foreign central bank-driven inflow.

- U.S. has to move people from construction and consumer goods to export and import-competing goods. (8M?)

- Foreigners have to move people from export industry into construction and consumer goods. (40M?)

Why can't the current configuration go on forever? Consider China, currently at $250B a year (12% of Chinese GDP) with foreign exchange reserves of $1T (50% of Chinese GDP). In a decade, at the current pace, foreign exchange reserves of $4.5T (110% of future Chinese GDP). Losses on foreign exchange reserve portfolio: to buy dollars at $1=8RMB and then to sell them at $1=16RMB is expensive.

- What happens just before foreign central banks abandon their dollar-purchase programs?

- What happens just before that?

- And just before that?

http://delong.typepad.com/teaching_spring_2006/2007/01/in_condemnation.html